support to private company owners

wanting the best possible exit

Specialist advisory support for private business owners aimed at creating maximum value for an eventual exit, Ongoing bespoke programme and support helps shape and execute growth and exit strategies.

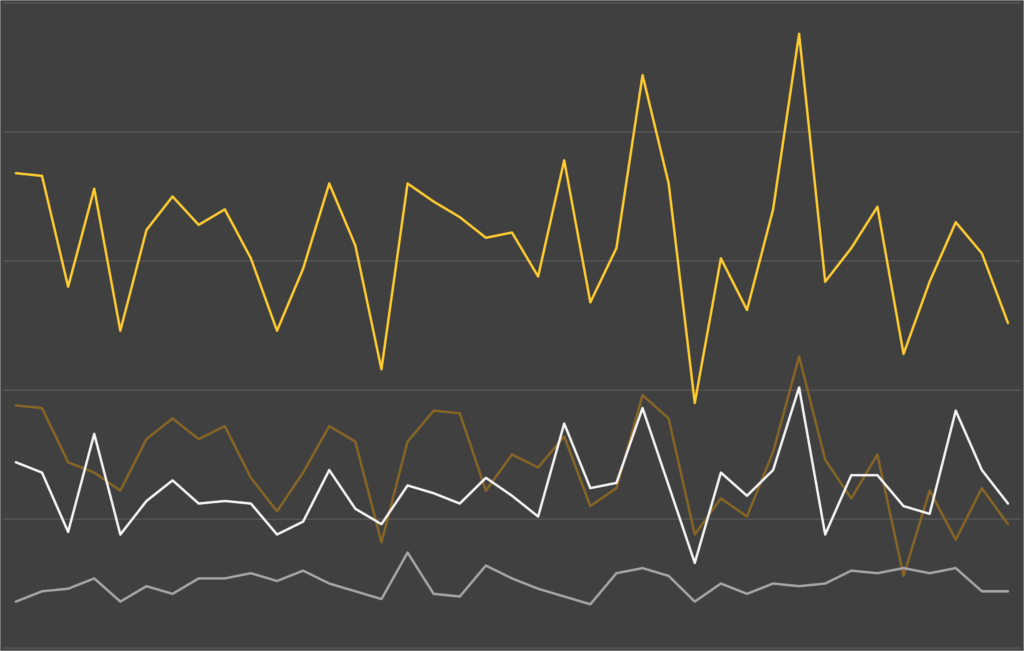

In-depth action plan using CF data analysis providing a comprehensive ‘go-to-market’ strategy. Benchmarking against main competitors, valuation guide, exit options, identifies typical buyers.

A comprehensive company sale service from initial instruction through to completed sale. High-level corporate finance support, strong research facility combined with exceptionally experienced sales ability at CEO level.

The UK Office for National Statistics have just released their latest statistics for Q4-25. Below is the update...

The latest M&A report by Datasite (in conjunction with partnership with Mergermarket) offers useful European insight into the...

The recent PitchBook M&A report on 2025 deal-making contained a strong message: 2025 was the year dealmaking decided...

Artificial Intelligence, AI, is making its way into the headlines for pretty much every industry. So, how about...

The UK Office for National Statistics have just released their latest statistics for Q3-25. Below is the update...

TheNonExec will be closing for the holiday period on Friday 19th December 2025 and we will re-open on...